Roanoke Valley March 2023 & 2023 1st Quarter Real Estate Review

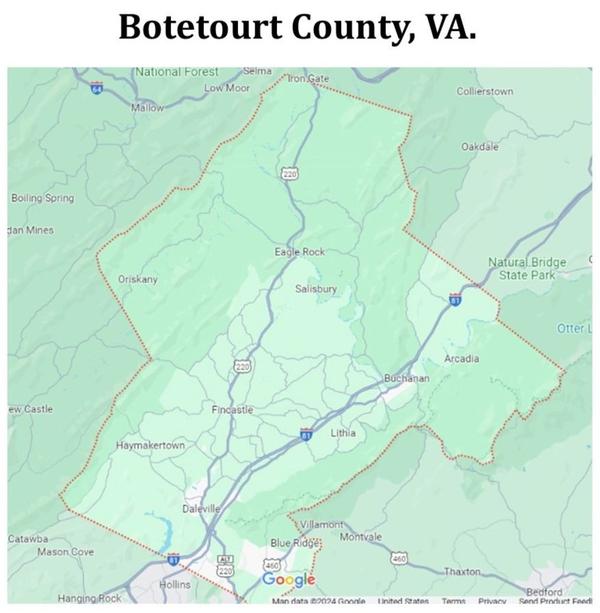

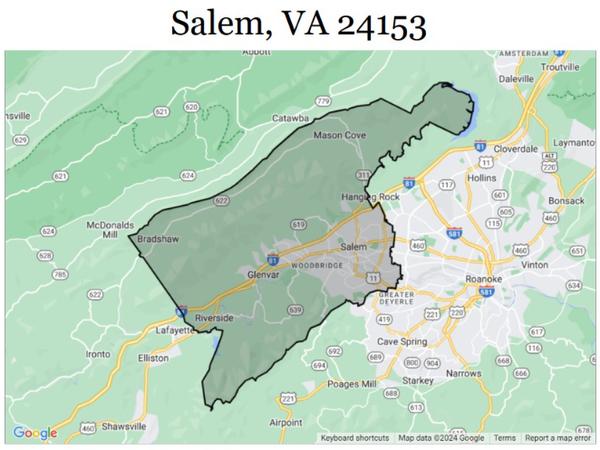

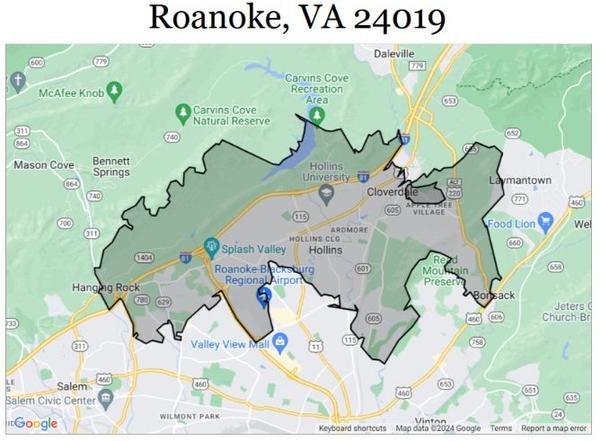

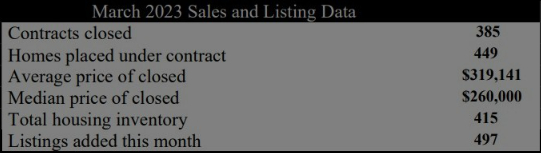

The following statistics show the number of homes sold through the Multiple ListingService of Roanoke Valley during the month of March 2023. 75 fewer homes were sold in 2023 versus 2022, the great news for sellers is the average sale price continues to rise. The average sale price was up almost $30,000 or roughly 10%. Inventory remains an area of concern with 497 homes listed for sale, 449 went under contract, and a total housing inventory of 419. 1st quarter numbers show a sluggish market with rising prices and lower available homes for sale. There were 170 fewer houses listed for sale in the 1st quarter of 2023 than in 2022. The 2022 average sale price in the first quarter was $292,022 and has risen in 2023 to $319,762. The first quarter of 2023 is also the first time that the average sale price has exceeded $300,000 in each month. If you have thought about selling your home at any time in the last 6 to 12 months please reach out to us so that we can give you an up-to-date and accurate home value that is based on your unique situation. We are available to assist you and can be reached at 540-491-4222. Previous Blogs The Big Three - FHA, USDA, and Conventional loans, and their differences. Declutter your home before listing

Decluttering can make your home sell faster!

As a seller, one of your ultimate goals is to sell your home as quickly as possible. Decluttering can make that possible for you. It's an effective way to showcase your home's true potential to potential buyers. In this blog, we'll discuss how decluttering can make your home sell faster and why it's important. Market Update The real estate market is highly competitive, and buyers have a wide range of options to choose from. In such a scenario, it's essential to present your home in the best possible way. By decluttering your home, you can create a more spacious and organized look that will appeal to buyers. Buyers are more attracted to homes that they can easily visualize themselves living in without feeling cramped. Lifestyle Living in a cluttered environment can lead to stress and anxiety. Decluttering your home can make it a more calming space to live in. By removing excess furniture, personal photos, and knickknacks, you can make your home look and feel larger. You'll be surprised at the difference it can make in the overall feel of your home. Not only will it be more relaxing, but it will also be more inviting to potential buyers. Remove Excess Furniture It's important to keep in mind that your home is not a storage unit. Remove any excess furniture that is taking up valuable space. Clearing up space will create a more spacious and airy feel, which is attractive to potential buyers. It will also make the room look more organized and easy to navigate. The less furniture you have, the larger the room will appear. Remove Personal Photos Personal photos hold sentimental value but can distract potential buyers from seeing the home as their own. Remove all family photos and personal collections. When buyers see these, they may feel like they're intruding on your personal space. By removing these items, you're creating a blank slate for potential buyers to imagine themselves in the space. Reduce the Number of Knickknacks Knickknacks may be sentimental, but they can make the home look cluttered. It's essential to reduce their number and only keep what is necessary. Large collections of figurines or other small items can be overwhelming and take away from the beauty of the space. Removing these items will create a more streamlined and polished look. In conclusion, decluttering your home is an effective way to sell your home faster. By removing excess furniture, personal photos, and knickknacks, you can create a spacious and calming space that will appeal to potential buyers. Remember, less is more when it comes to selling your home. The goal is to create a blank slate that buyers can envision themselves living in. Our team performs walk-throughs of every home we list and makes suggestions on creating a buyer-friendly atmosphere within your home. Let us shine the spotlight on your home this Spring! Reach out to us at 540-491-4222 Previous Blogs Get Curb Appeal For Your Home Why Dual Agency Can be a Mistake

FHA, USDA, and Conventional Loan differences

When it comes to buying a home, there are many different types of loans available to buyers. Three of the most popular loan types are FHA, USDA, and Conventional loans. Each loan type has its own guidelines and requirements, so it's important to understand the differences before making a decision. Buyers FHA loans are a popular choice for first-time homebuyers who have limited funds for a down payment. With an FHA loan, buyers can put down as little as 3.5% of the purchase price. This is a great option for buyers who may not have a lot of money saved up for a down payment. USDA loans are designed for buyers in rural areas who have low to moderate incomes. These loans are backed by the U.S. Department of Agriculture and offer 100% financing, meaning buyers don't need to put any money down. Conventional loans are available to all types of buyers, including first-time homebuyers and those with higher incomes. These loans typically require a down payment of at least 5% but can be as high as 20% depending on the buyer's credit score and income. Mortgage FHA loans have a maximum loan amount that varies by county. In general, the maximum loan amount for an FHA loan is $356,362 in most counties. FHA loans require mortgage insurance premiums (MIP) which are typically included in the monthly mortgage payment. USDA loans have a maximum loan amount that varies by county. In general, the maximum loan amount for a USDA loan is $548,250 in most counties. USDA loans also require a funding fee which is typically included in the loan amount. Conventional loans do not have a maximum loan amount, but they do have a limit on the amount of money that can be borrowed without requiring private mortgage insurance (PMI). This limit is typically around 80% of the home's value. Conventional loans do not require any additional fees like MIP or funding fees. Guidelines FHA loans have specific guidelines that borrowers must meet in order to be eligible for the loan. These guidelines include a minimum credit score of 580, a debt-to-income ratio of 43%, and a maximum loan-to-value ratio of 96.5%. USDA loans have specific guidelines as well. In order to be eligible for a USDA loan, borrowers must have a minimum credit score of 640, a debt-to-income ratio of 41%, and the home must be located in a designated rural area. Conventional loans also have specific guidelines. Borrowers must have a minimum credit score of 620, a debt-to-income ratio of 45%, and a maximum loan-to-value ratio of 97%. In summary, there are several differences between FHA, USDA, and conventional loans. Buyers should consider their financial situation and the requirements of each loan type before making a decision. FHA loans are great for first-time homebuyers who have limited funds, USDA loans are designed for buyers in rural areas with low to moderate incomes, and conventional loans are available to all types of buyers with varying credit scores and incomes. Our team can recommend a local lender, Dave Henry with the Henry Mortgage Group, he has extensive mortgage experience and knowledge. Previous Blogs Learn about Closing Costs How to make an offer on a home

Categories

Recent Posts