Earnest money? Down Payment? What's the Difference?

Earnest money? Down Payment? What's the Difference? There are two terms you will hear if you’re in the market to buy a house—earnest money deposit and down payment. The two are not interchangeable, but they’re regularly confused. So let’s talk about what they are, what they aren’t, and how they compare. Understanding both earnest money and a down payment is critical to buying a home. Too often, buyers will think only about the down payment they have to make upfront, but they don’t consider other costs. What is Earnest Money? The objective of earnest money is to show a seller that you’re entering this transaction in good faith. Earnest money you might also hear referred to as an escrow deposit. Earnest money or an escrow deposit is an amount of money that you, if you’re a buyer, put into an escrow account only after a seller accepts your offer. Another way to look at earnest money is as if it’s a security deposit. An earnest money deposit is not a good-faith deposit. Under some circumstances, your earnest money might be refundable. What your earnest money does is allow you a specific amount of time to get your mortgage financing in order and go through any other steps in the buying process, like inspections and appraisals. Earnest money is usually calculated as either a fixed amount or a percentage. Which one you’d pay depends mainly on the market where you’re buying. If you’re in a competitive market, earnest money deposits are a good way to set your offer apart. If you can put forth a bigger earnest money deposit, you’re signaling that you might be a safer buyer. If you can put that money up early on, the seller might feel you’re more financially stable, so they can worry less about something causing the sale to fall apart at the last minute. If you make it to loan closing, then your earnest money deposit goes toward your down payment. If you don’t make it to closing, you may lose your earnest money. To guarantee you get it back, you should have contingencies in place to protect the deposit, like a home inspection or appraisal contingency. What’s a Down Payment? A down payment is something that, as a buyer, you can put toward the purchase of a home. The seller receives it, and then the rest of the home's purchase price comes from your mortgage. Lenders require down payment minimums. The minimum required amount is typically determined by the type of loan you are getting. In some cases, it could be zero down. The larger the down payment you can make the lower your mortgage payment will be. It could also affect the mortgage rate you receive. If your down payment is less than 20%, your lender will probably require you to buy private mortgage insurance or PMI. PMI is a way for your lender to protect itself if you default on your loan. Key Takeaways Both earnest money and a down payment are essential parts of buying a house. Earnest money can sometimes be returned if the transaction doesn’t go through if you have contingencies. In some cases, a seller will get to keep your earnest money if you don’t go through with the purchase. A buyer and seller can usually negotiate on earnest money, and it can be anywhere from 1% to 2% of the purchase price, up to 10% in very hot markets. A lender requires a down payment as part of your mortgage, and you don’t negotiate it with your seller.

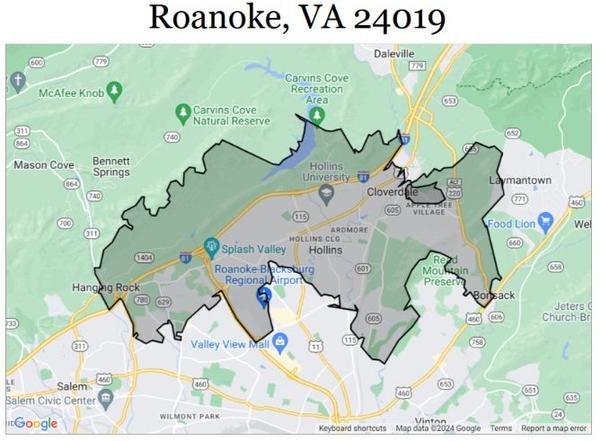

Get Curb Appeal in Roanoke

If you are thinking about selling your home in Roanoke VA. first impressions matter. Enhancing your front yard so people will stop and stare is a great way to get homebuyers to make an offer. The good thing is it doesn't have to cost a fortune. Here are 4 simple tips to get that curb appeal dialed in. Paint that door! First on your to-do list should be the front door, it is where you greet any potential buyers. While the buyer’s agent is opening the lockbox the potential buyers are looking at your front door and porch, make sure it pops! A beautiful front door color can completely refresh your home." You can go with a tried-and-true classic like black or charcoal or pick a bold hue like bright red or yellow. Whichever way you go make sure to get that trim painted too. Clean, clean, clean A marathon cleaning session can also do wonders for your curb appeal. Give your home’s exterior surface a good spit-shine and polish to make it look fresh and well cared for. Rent a pressure washer and clean the driveway, walkways, fences, gutters, siding and whatever else looks grungy. Clean out the planting beds, get rid of dead leaves, branches, trash, and trim back overgrown plantings. As for pruning, if your shrubs look "leggy," or show more branches than greenery, they likely need some extra snipping. It's best to prune manually, using very sharp tools; motorized pruners simply skim the surface, which can lead to blocked light and poor air circulation. Granted, not every shrub in your yard must be pruned. Talk to an expert at your nursery or do a quick internet search to find out how much maintenance your plants require. Light it up Buying new exterior light fixtures can instantly improve the look of your home, both day and night. You want them to be able to adequately illuminate your entryway and make it safer. Look for fixtures that have the same mounting system as the current ones and that will save time and money. Exterior light fixtures can be found from $25 and up. Check salvage shops if you want to try to find vintage lighting to match the age and look of your home. Don’t forget the mailbox It's all about the details, so if your mailbox is rusty or looks like it's going to topple over, it might be time to bring a new one in. If you have a mailbox on the street, consider replacing it if it looks old and shabby. The price of a new mailbox starts at around $20, and a post and concrete won't be much more. Even painting the existing post can create a huge difference. You know curb appeal when you see it. Yet sometimes it's hard to pinpoint what exactly makes a particular house on the block so much more welcoming than the next. These simple tips can be the difference maker you need. If you are thinking of selling your home in the Roanoke Valley this year we are here to help. Please let us know of any questions you have; you can call or text 540-537-9281.

Categories

Recent Posts