How To tell How Much Mortgage Money You Can Borrow

How to Tell How Much Mortgage Money You Can Borrow

How much can you afford to borrow when getting ready to buy a home? That depends upon several factors, some more important than others. Affordability is generally determined by your monthly payment. Your monthly payment is affected by current market rates and the size of your home loan. In addition, the length of your loan will also affect the monthly payment. Shorter-term loans for example may have a slightly lower rate but because the loan is squished into a 10-year term compared to the more common 30-year loan, the payment will be higher.

So let’s start. Generally speaking, the mortgage payment should be around one-third of your gross monthly income. When lenders evaluate affordability, they look at not just the mortgage payment but also the amount for monthly property taxes and insurance. That’s the number they use, not just your principal and interest payment. If the gross monthly income of all borrowers on the note amounts to $9,000, then lenders like to see your total payment around $3,000.

But what about all your other bills, are they factored into that one-third amount? No. Other payments that would appear on a credit report are included. This includes both installment and revolving debt. Installment debts are those such as auto loans that have fixed payments every month. Over time, the car is eventually paid off. The car payment is figured into this amount, but only if more than 10 payments are remaining. Revolving debt is like your credit card. The balance can change every month and so will the payments. Everyday bills such as utilities, food, etc won’t count. For this payment, lenders like to see these bills be around 40-43% of gross monthly income.

However, how much you can borrow can also depend upon your credit score. Borrowers with high credit scores might be able to borrow more than someone with less than stellar credit. Your loan officer will help you out with these numbers if you need some assistance early on.

Finally, how much you can borrow also depends upon how comfortable you are with the new monthly payments. It might surprise some to find out what they can qualify for compared to what they’re paying now in rent. If you're told you can borrow up to a certain amount but you’re not comfortable with that amount and would like to borrow less, by all means, pay what you feel comfortable with, not necessarily how much your lender said you can borrow.

The Roanoke Real Estate Team can help you find reputable and friendly local lenders who understand the needs of homebuyers in the Roanoke Valley.

Reach out to us at 540-537-9281 for help.

Previous Blogs

Tips for Negotiating With Sellers in the Roanoke Valley

7 Steps to Get Your Home Ready to Sell

Categories

Recent Posts

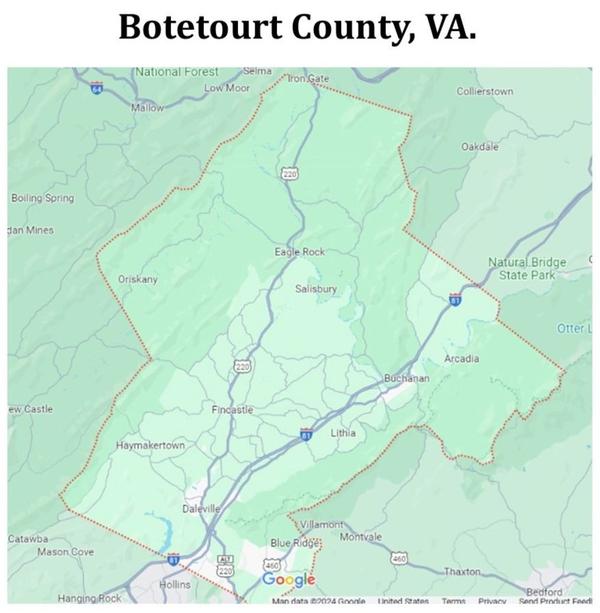

Real Estate Market Snapshot: Trends and Insight for Botetourt County

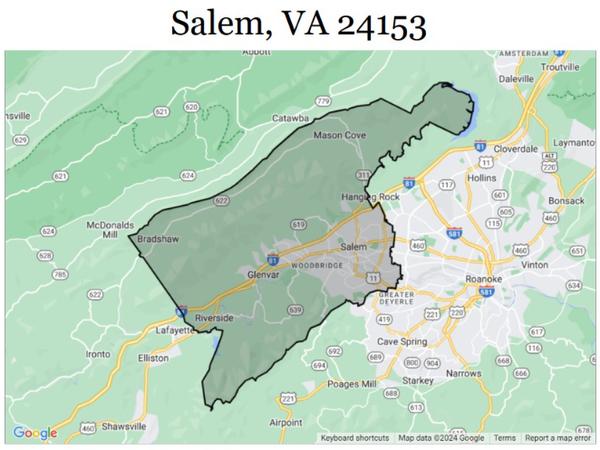

Real Estate Market Snapshot: Trends and Insight for 24153

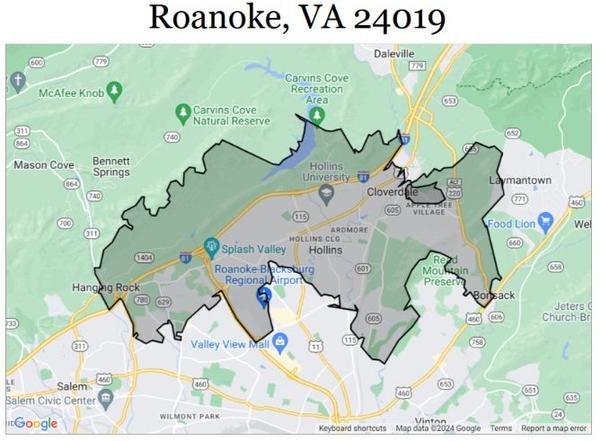

Real Estate Market Snapshot: Trends and Insights for 24019

Getting Ready to Buy a New Home: 3 Tips

Real Estate Market Snapshot: Trends and Insight for 24018

5 tips to Remove the Emotion of Decluttering

Buying a Home? Look Past The Cosmetic Updates

Would you like your house to sell faster and for more than you expect?

Should You Get A Pre-Listing Home Inspection?

How Color Helps Sell Your Home