FHA, USDA, and Conventional Loan differences

When it comes to buying a home, there are many different types of loans available to buyers. Three of the most popular loan types are FHA, USDA, and Conventional loans. Each loan type has its own guidelines and requirements, so it's important to understand the differences before making a decision.

Buyers

FHA loans are a popular choice for first-time homebuyers who have limited funds for a down payment. With an FHA loan, buyers can put down as little as 3.5% of the purchase price. This is a great option for buyers who may not have a lot of money saved up for a down payment.

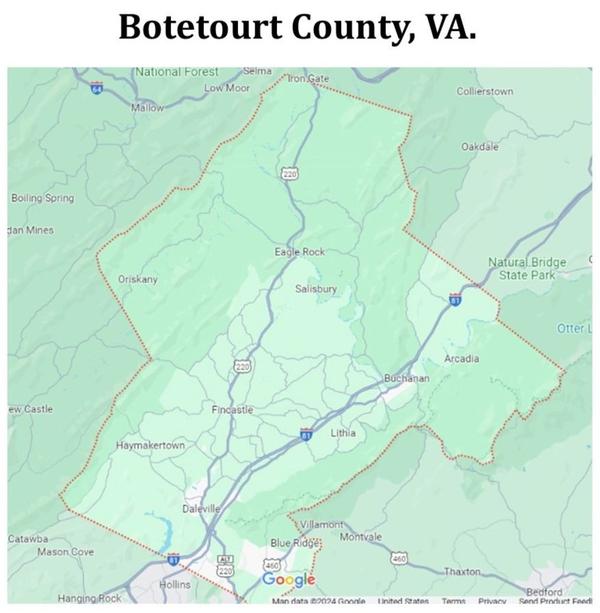

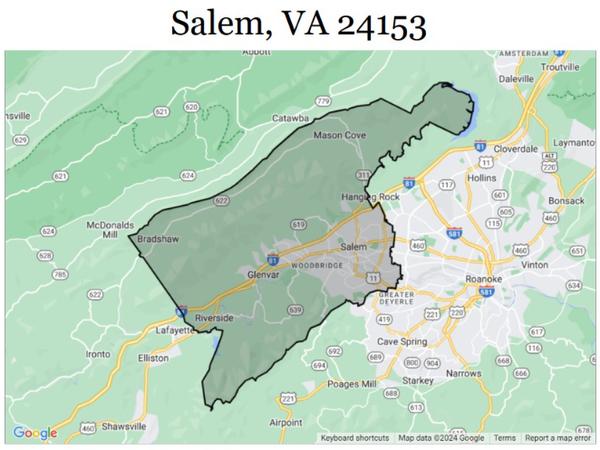

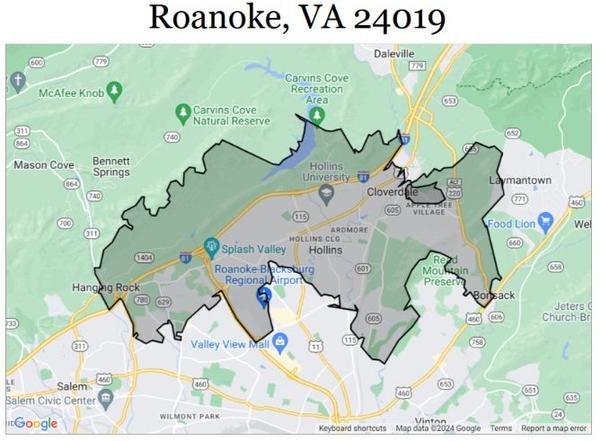

USDA loans are designed for buyers in rural areas who have low to moderate incomes. These loans are backed by the U.S. Department of Agriculture and offer 100% financing, meaning buyers don't need to put any money down.

Conventional loans are available to all types of buyers, including first-time homebuyers and those with higher incomes. These loans typically require a down payment of at least 5% but can be as high as 20% depending on the buyer's credit score and income.

Mortgage

FHA loans have a maximum loan amount that varies by county. In general, the maximum loan amount for an FHA loan is $356,362 in most counties. FHA loans require mortgage insurance premiums (MIP) which are typically included in the monthly mortgage payment.

USDA loans have a maximum loan amount that varies by county. In general, the maximum loan amount for a USDA loan is $548,250 in most counties. USDA loans also require a funding fee which is typically included in the loan amount.

Conventional loans do not have a maximum loan amount, but they do have a limit on the amount of money that can be borrowed without requiring private mortgage insurance (PMI). This limit is typically around 80% of the home's value. Conventional loans do not require any additional fees like MIP or funding fees.

Guidelines

FHA loans have specific guidelines that borrowers must meet in order to be eligible for the loan. These guidelines include a minimum credit score of 580, a debt-to-income ratio of 43%, and a maximum loan-to-value ratio of 96.5%.

USDA loans have specific guidelines as well. In order to be eligible for a USDA loan, borrowers must have a minimum credit score of 640, a debt-to-income ratio of 41%, and the home must be located in a designated rural area.

Conventional loans also have specific guidelines. Borrowers must have a minimum credit score of 620, a debt-to-income ratio of 45%, and a maximum loan-to-value ratio of 97%.

In summary, there are several differences between FHA, USDA, and conventional loans. Buyers should consider their financial situation and the requirements of each loan type before making a decision. FHA loans are great for first-time homebuyers who have limited funds, USDA loans are designed for buyers in rural areas with low to moderate incomes, and conventional loans are available to all types of buyers with varying credit scores and incomes.

Our team can recommend a local lender, Dave Henry with the Henry Mortgage Group, he has extensive mortgage experience and knowledge.

Previous Blogs

How to make an offer on a home

Categories

Recent Posts